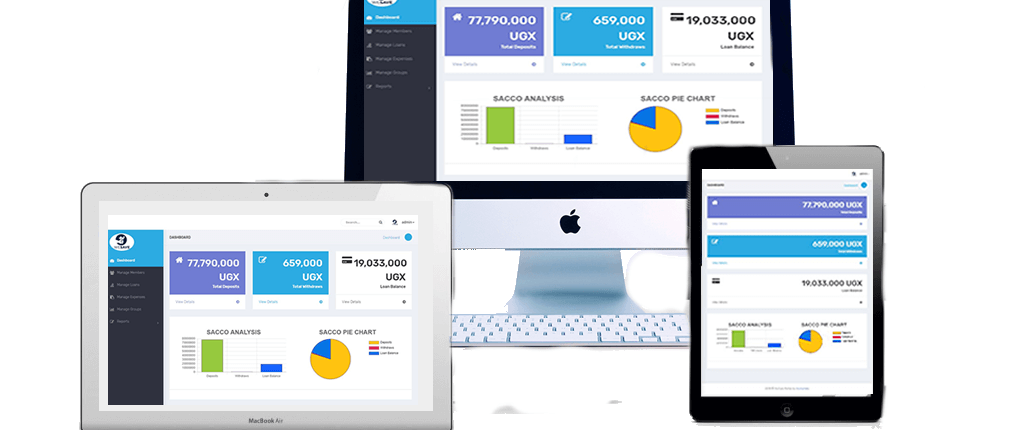

This system is an integrated Sacco and micro finance management system with a number of modules which enable a Sacco to manage its operations from loans applications to disbursement, savings and withdrawals,expenses,shares, accounts functionality, financial accounting and reporting, shares/deposits management, front office administration and group’s management.

Its user friendly and reliable and more so affordable and modern

Member Management

- Allows SACCOs & microfinance institutions to register their clients & open their accounts.

- Captures, processes & analyzes bio data, demographic data from members and clients.

- Produce customised accounts reports like dornant accounts,deceased memebers accounts,most active accounts

- Client register by category, date opened, status, (customized to give client register by key fields.

- Dormant client accounts, deceased clients account, closed client accounts, client withdrawal report

- user activity log on client records i.e. Record user name, record date and time of creation / modification of client record

SMS /EMAIL NOTIFICATIONS

The application has capability to

- Allows SACCOs & microfinance institutions to register their clients & open their accounts.

- Captures, processes & analyzes bio data, demographic data from members and clients.

- Produce customised accounts reports like dornant accounts,deceased memebers accounts,most active accounts

- Client register by category, date opened, status, (customized to give client register by key fields.

- Dormant client accounts, deceased clients account, closed client accounts, client withdrawal report

- user activity log on client records i.e. Record user name, record date and time of creation / modification of client record

Expense Tracking

- Expense Categories

- Expense details

- Customised expenses reports (expense reports by category,expense reports by date,expense reports by individual who authorised it)

- Graphical analysis of expenses

Loans Management

- Allows User /SACOto create different loan products like school fees loans,Agriculture loans,youth loans,etc

- It caters for both reducing and flat rate interest rates

- Allows to monitor performance of individual credit officer/loans officer

- Enables loans officers to manage their client portifolio

- Produce customised loan reports like disbursed loans report,pending approval,rejected loan report,Loan issued beyond the appraisal parameters,Guarantors report

Customised reports

-

- Loan application report

- Loan approved report

- Approved loans but pending disbursement

- Rejected loan report

- Disbursed loan report- able to show loan disbursed partly

- Repayment schedule of all loans (whether paid/not paid)

- Loan delinquency report ( ability to give reports based on time/period , employers, station e.t.c

- Loan underpayment report

- Negative loan balances / overpaid loan reports

- Client loan listing – detailed & summary & be categorized by employer, station, period

- Loan movement schedule

- Loan issued beyond the appraisal parameters

- Guarantors report